iNVEST

Why invest in aadhar asset management ?

Investment starting from only ₹500 onwards.

we enable you to invest in real estate.

Start Small Investment

Click to Buy Click To sell

Diversify Investment

Anytime Book the Profit

Track Your Investment

Multiple Choice of Investment

Real Estate Owned Digitally

24*7 Real Estate Trading

Active investment

SECURED DEBENTURE-SEQUEL 1

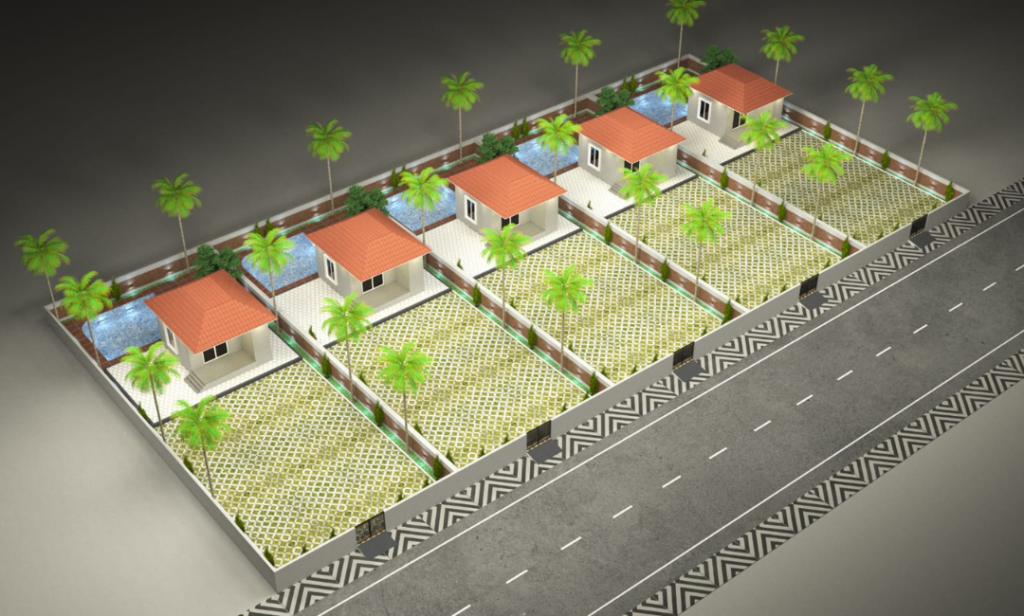

Farm House Land

Total Land 29000 Sqft

SECURED DEBENTURE-SEQUEL 2

SECURED DEBENTURE-SEQUEL 3

Property Selection Criteria

Our Team

Our team is managed and guided by our expert mentors, Who have achieved excellent exposure

We follow certain quality guidelines that include:-

- We are openly communicate with one another with the ability to confidently share their thoughts, ideas and opinions with the wider team.

- We have flourished in our business and satisfied our customers to make long term Relationship with them.

- We use our experience and skills to find a solution and so diversity is key within this process.

Our Team

Our team is managed and guided by our expert mentors, Who have achieved excellent exposure

We follow certain quality guidelines that include:-

- We are openly communicate with one another with the ability to confidently share their thoughts, ideas and opinions with the wider team.

- We have flourished in our business and satisfied our customers to make long term Relationship with them.

- We use our experience and skills to find a solution and so diversity is key within this process.

SECTOR WHERE INVEST

AGRICULTURAL LAND

Agriculture has been the backbone of civilizations throughout history, and today it stands at the intersection of economic growth and environmental sustainability. Investing in Agricultural Land is not merely a financial decision; it's a strategic move towards securing the future of our planet and meeting the growing demands of a burgeoning global population.

COMMERCIAL LAND

Welcome to Aadhar Asset Management Company, your partner in strategic investments that transcend traditional boundaries. In our pursuit of excellence, we proudly present the compelling opportunities that lie within the dynamic sector of Commercial Land. Commercial land stands as a symbol of economic vibrancy and growth, acting as a cornerstone for various business activities. Investing in this sector isn't just about real estate; it's about participating in the evolution of urban landscapes and fostering economic development.

CORPORATE LAND ACQUISITION

Corporate firms represent the heartbeat of economic vitality, driving innovation, employment, and progress. Investing in this sector goes beyond traditional financial strategies; it's about actively participating in the success stories of industry leaders and contributing to the evolution of global business landscapes.

REIT (Real estate investment trust)

Real Estate Investment Trusts (REITs) have emerged as a powerful vehicle for investors seeking exposure to the real estate market without the burden of direct property ownership. These investment instruments offer a unique blend of stability, income, and growth potential, making them an attractive addition to diversified investment

Fracture Investment

In the dynamic landscape of investment opportunities, one sector stands out for its potential to yield significant returns while contributing to transformative innovations – Fracture Investments. Fracture, the art and science of identifying and exploiting fractures in the market, presents a unique avenue for investors seeking high-growth prospects and strategic diversification.

aquire BANK PROPERTY

Investing in the Bank Property sector with Aadhar Asset Management Company] is not just about acquiring real estate; it's about strategically positioning your assets in a sector synonymous with stability and reliability. Join us on this journey to elevate your portfolio through strategic and lucrative bank property investments. Contact us today to embark on a path where financial stability meets prime real estate opportunities.

FARM HOUSE

Farm houses represent a harmonious blend of natural beauty, tranquility, and the promise of a slower-paced lifestyle. Investing in this sector offers not just a financial venture but a retreat into a world where verdant landscapes meet the promise of a peaceful and fulfilling escape.

- Serene Lifestyle Investment

- Land Appreciation

- Diversification of Real Estate Portfolio

ROW HOUSE

Row houses, with their distinctive architectural charm and efficient use of space, represent a unique segment in the real estate market. Investing in this sector is not just about acquiring property; it's about curating a lifestyle that seamlessly blends elegance, convenience, and community living.

- Architectural Appeal

- Potential for Rental Income

WARE HOUSE

Warehouses serve as the backbone of global supply chains, playing a pivotal role in the efficient storage and distribution of goods. Investing in this sector is not just about bricks and mortar; it's about positioning your assets in a key infrastructure component that drives economic progress and resilience.

JOINT VENTURE

Joint Ventures (JVs) represent a collaborative approach to investment, where two or more entities come together to combine resources, expertise, and capital for mutual benefit. Investing in this sector isn't just about financial returns; it's about leveraging synergies to unlock opportunities that may be beyond the reach of individual investors.

VENTURE CAPITAL

Venture Capital (VC) represents the heartbeat of innovation, propelling groundbreaking ideas and startups into industry leaders. Investing in this sector is a testament to a forward-thinking approach, where your assets become catalysts for transformative change and technological advancement.

How investment is processed?

Fractional ownership

Fractional ownership refers to an arrangement wherein group of investors pool their funds to purchase a high-value asset and share passive ownership of it through a Special Purpose Vehicle (“SPV”). Though the funds are raised through an SPV, investors will own shares of the SPV that holds the Asset. The asset here can be anything such as Commercial land , farm house, row house, venture capital, joint venture, bank property, corporate firm, agricultural land

1. Register & Complete your KYC

2. Choose your Active plan & invest

3. Allotment of debenture & credit of debenture

4. Receive interest on debenture

5. Monitor & enjoy your returns

6. Redemption of debenture at the end of the tenure

Taxation

As Aadhar Assect Management chooses Limited Liability Partnership firm (LLP) as the form of business for Special purpose Vehicle (SPV), the monthly payout is not taxable in the hand of investors under Section 10 (2A) of Income Tax Act, 1961.

Debt Funding

Debt Fund investment is fixed income instruments such as Loan, Debenture, Corporate Bonds and Corporate debt securities. Debt financing occurs when a company raises money by selling debt instruments, most commonly in the form of Loan or Debentures. Principal value, repayment term and the interest rate are mentioned in the Debenture Certificate. Individuals or entities that lend a Loan or purchase the Debenture become creditors to the business.

1. Register & Complete your KYC

2. Choose your Active plan & invest

3. Allotment of debenture & credit of debenture

4. Receive interest on debenture

5. Monitor & enjoy your returns

6. Redemption of debenture at the end of the tenure

Taxation

Interest paid against loan or debenture in any form of business is subject to TDS at a rate of 10% under Section 194 A / 195 of Income Tax Act, 1961.